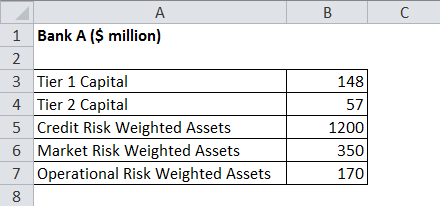

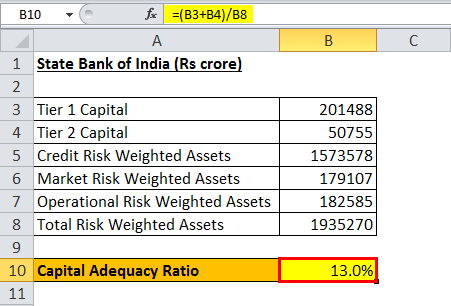

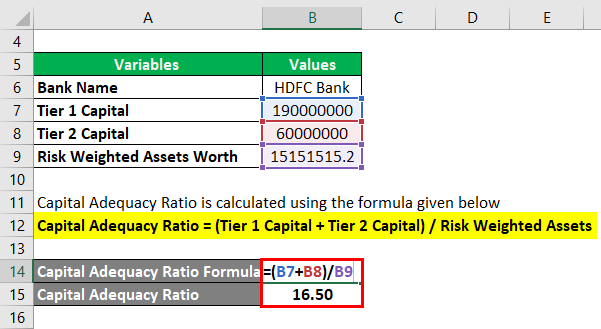

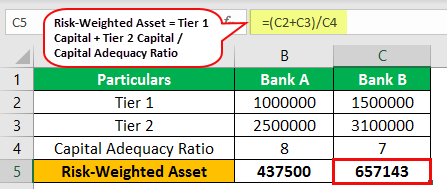

Dheeraj on Twitter: "Risk-Weighted Asset Definition (Formula, Examples) | Advantages https://t.co/t8U4glNhIR #RiskWeightedAssetDefinition https://t.co/LxE9ToypeP" / Twitter

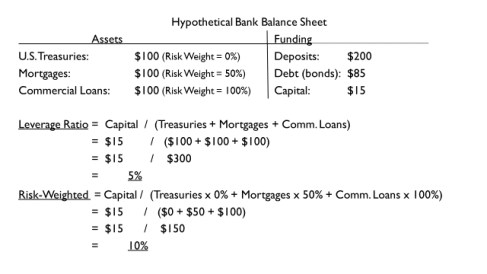

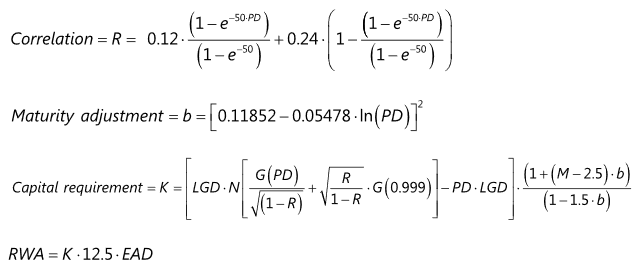

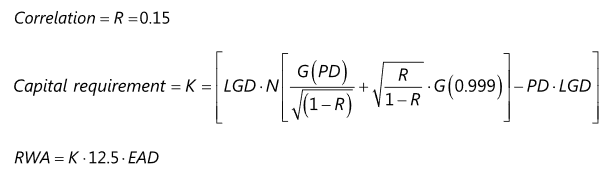

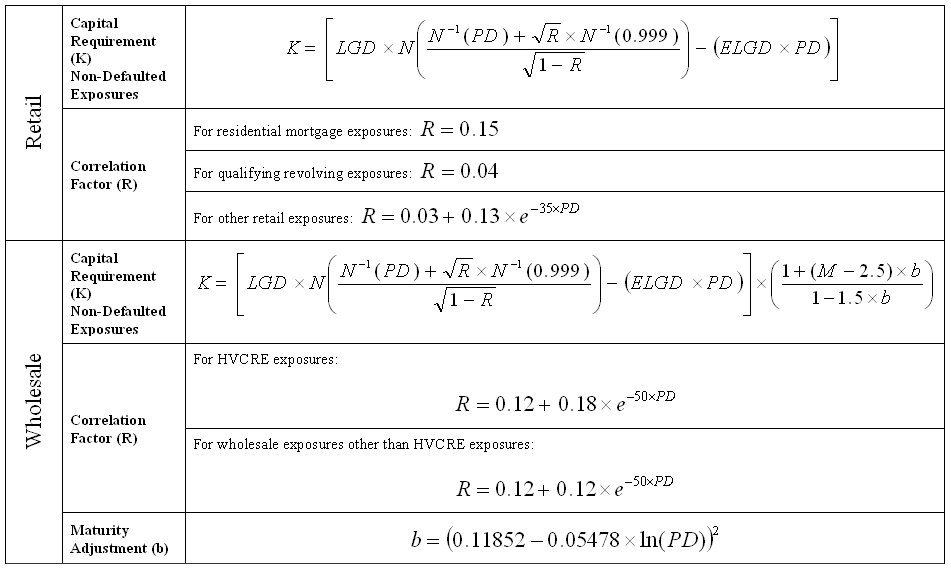

FDIC: FIL-86-2006: Proposed Rule on Risk-Based Capital Standards: Advanced Capital Adequacy Framework

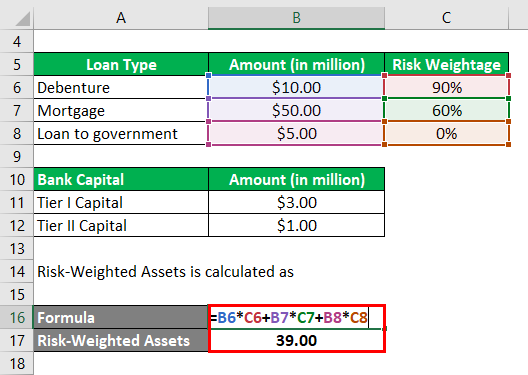

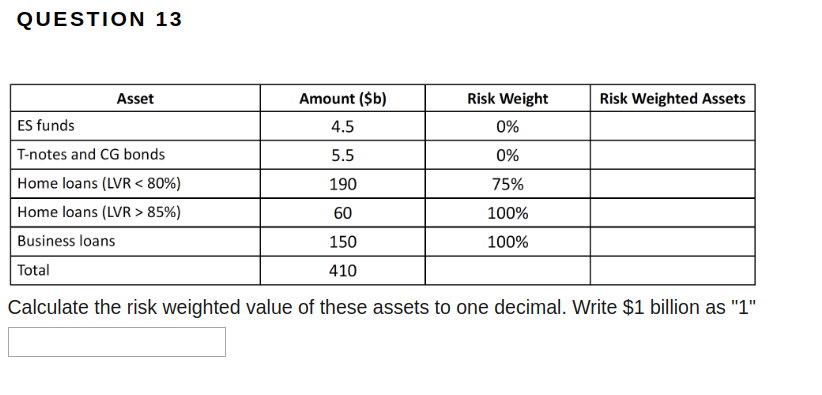

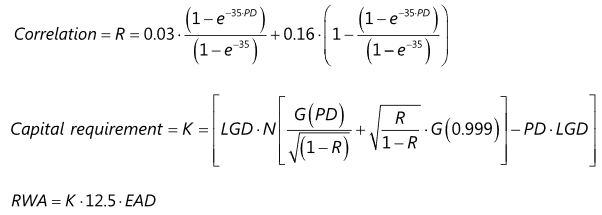

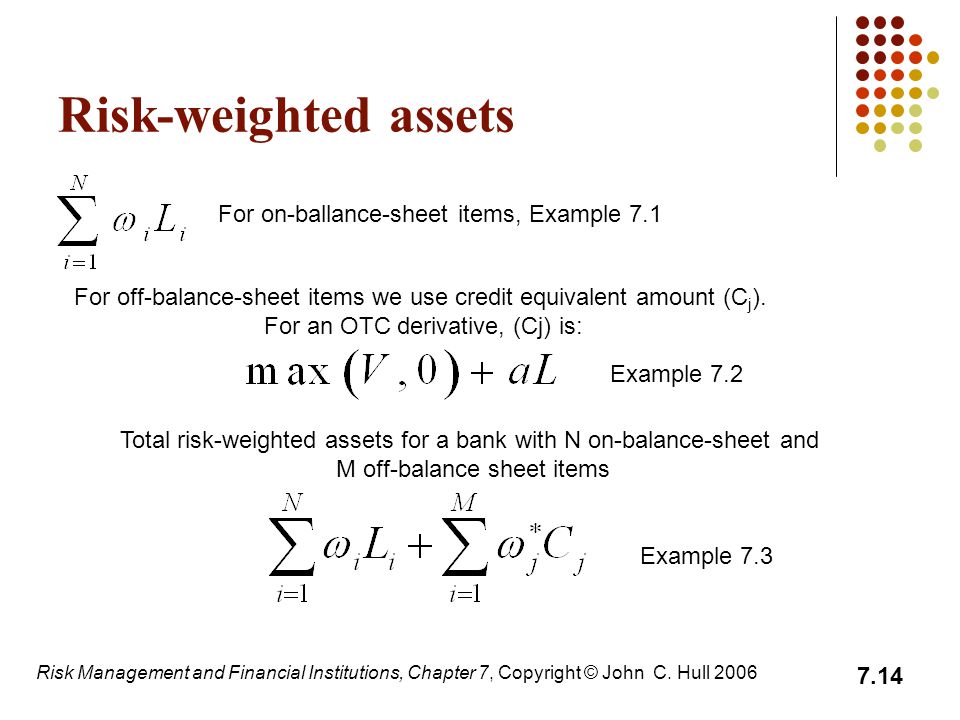

Basel II Capital Accord - Notice of proposed rulemaking (NPR) - Preamble - Calculation of Risk-Weighted Assets

Meaning of Capital charge and calculation of capital requirement — Banking School - India Dictionary